Find the Right Coverage: Medicare Advantage Plans Near Me

Find the Right Coverage: Medicare Advantage Plans Near Me

Blog Article

Browsing the Registration Refine for Medicare Advantage Insurance

As people approach the phase of considering Medicare Benefit insurance, they are met a labyrinth of choices and laws that can in some cases really feel overwhelming. Understanding the qualification requirements, numerous protection alternatives, enrollment periods, and the essential steps for registration can be an awesome job. Nonetheless, having a clear roadmap can make this navigating smoother and much more manageable. Allow's explore just how to effectively navigate the registration process for Medicare Benefit insurance.

Eligibility Needs

To receive Medicare Benefit insurance, individuals must fulfill details qualification demands described by the Centers for Medicare & Medicaid Provider (CMS) Qualification is mainly based on variables such as age, residency status, and registration in Medicare Part A and Part B. Many people aged 65 and older get Medicare Benefit, although particular people under 65 with certifying impairments may likewise be qualified. Furthermore, people need to stay within the solution location of the Medicare Benefit strategy they want to sign up in.

Additionally, individuals have to be registered in both Medicare Part A and Part B to be eligible for Medicare Advantage. Medicare advantage plans near me. Medicare Benefit strategies are required to cover all services offered by Original Medicare (Part A and Part B), so registration in both components is necessary for people looking for insurance coverage via a Medicare Benefit strategy

Coverage Options

Having satisfied the eligibility needs for Medicare Benefit insurance, individuals can currently check out the different protection options available to them within the plan. Medicare Advantage intends, likewise recognized as Medicare Component C, use an "all-in-one" option to Original Medicare (Part A and Component B) by offering fringe benefits such as prescription medication coverage (Component D), vision, dental, hearing, and health programs.

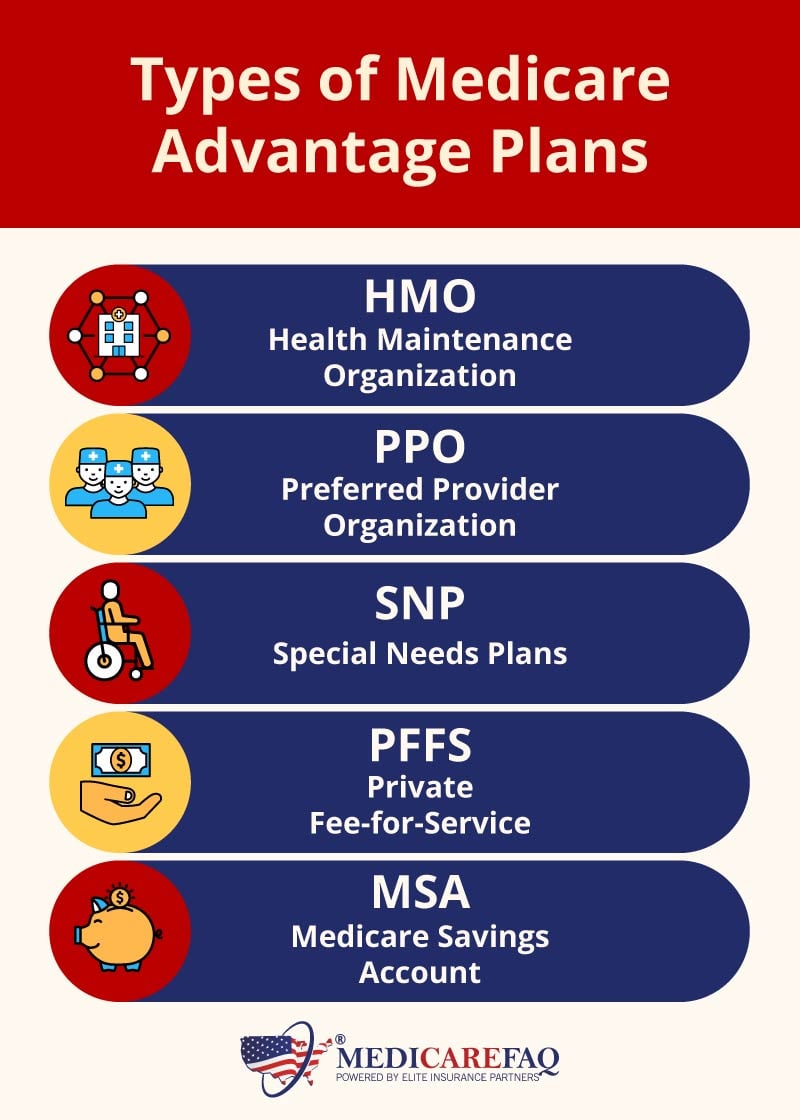

Among the primary insurance coverage choices to consider within Medicare Benefit prepares is Health care Company (HMO) plans, which typically call for individuals to select a medical care medical professional and get references to see specialists. Preferred Supplier Company (PPO) prepares deal more versatility in choosing doctor without recommendations but usually at a higher cost. Unique Requirements Strategies (SNPs) accommodate individuals with more tips here certain health conditions or those that are dually eligible for Medicare and Medicaid (Medicare advantage plans near me). Exclusive Fee-for-Service (PFFS) plans figure out how much they will pay doctor and just how much individuals will pay when they obtain care.

Understanding these protection alternatives is essential for individuals to make educated decisions based upon their healthcare requirements and preferences.

Registration Periods

Steps for Enrollment

Understanding the enrollment durations for Medicare Benefit insurance policy is vital for beneficiaries to navigate the procedure effectively and properly, which starts with taking the required actions for enrollment. The very first action is to identify your eligibility for he said Medicare Benefit. You need to be enlisted in Medicare Part A and Part B to receive a Medicare Advantage plan. As soon as qualification is confirmed, research and contrast readily available plans in your area. Consider elements such as costs, deductibles, copayments, insurance coverage options, and service provider networks to choose a plan that finest suits your healthcare needs.

You can enroll directly with the insurance coverage business supplying the strategy, with Medicare's website, or by speaking to Medicare directly. Be sure to have your Medicare card and personal information click this link prepared when registering.

Tips for Decision Making

When examining Medicare Advantage intends, it is important to thoroughly assess your private health care demands and monetary factors to consider to make a notified decision. To help in this process, consider the complying with suggestions for decision making:

Contrast Plan Options: Research offered Medicare Advantage plans in your area. Contrast their prices, insurance coverage advantages, service provider networks, and high quality scores to determine which lines up finest with your requirements.

Consider Out-of-Pocket Expenses: Look past the regular monthly costs and think about factors like deductibles, copayments, and coinsurance. Calculate possible yearly expenses based on your healthcare usage to locate the most cost-effective option.

Testimonial Star Scores: Medicare appoints star scores to Advantage intends based on elements like customer complete satisfaction and high quality of care. Selecting a highly-rated strategy may show better general efficiency and service.

Conclusion

Finally, understanding the eligibility requirements, protection options, registration periods, and steps for signing up in Medicare Benefit insurance policy is critical for making informed decisions. By browsing the registration procedure effectively and taking into consideration all readily available information, people can guarantee they are choosing the finest plan to meet their health care requires. Making educated decisions during the enrollment procedure can bring about better health results and monetary security in the long run.

Report this page